You've Made Money.

It's Time To Build Wealth.

Your Income Doubled.

Your Wealth Didn't.

Too often we see high income earners only getting middle-class outcomes. You deserve better. We coordinate tax, investment, and exit strategies into one family office tailored for business owners earning $300K+.

Making a Good Income Isn't the Same as Building Wealth

The Reality

It feels like you're crushing it.

Revenue up.

Team growing.

Clients happy.

Then you check your net worth.

The number doesn't match the effort.

Your business makes money, but you don't keep enough.

You own a successful business, but it owns your time.

There's a Financial Gap. A Big One.

We specialize in closing the divide between business success and personal financial independence.

The Problem:

Your Advisors Don't Talk to Each Other.

Your CPA files taxes.

Your advisor invests money.

Your insurance agent sells policies but...

Nobody Connects the Dots.

You're Waiting.

Every Quarter Costs You

For the bigger exit.

For the perfect moment.

For when you're "really wealthy."

Meanwhile, the window closes.

Every quarter without a plan costs you six figures.

Every year without coordination costs you millions.

A Better Way To Build Wealth

The Old Way

Siloed advisors working independently

Reactive tax planning in December

Investment strategy disconnected from business

Insurance sold, not coordinated

The Big Life Way

One team, coordinated strategy

Quarterly tax planning and modeling

Wealth systems built around your business

Legacy planning that evolves with you

Your Advisors Don't Talk to Each Other.

One team. One plan. One outcome.

How We Work

Four Core Services. One Coordinated Strategy.

Four Core Services. One Coordinated Strategy.

Tax Strategy

File Less. Keep More.

Most CPAs react. We architect. Quarterly planning that turns tax savings into wealth acceleration.

Wealth Coaching

Financial Operating System

Making money is easy. Building wealth isn't. We install the coordination layer you're missing.

R&D Tax Credits

Capital You Earned

Six and seven-figure credits most accountants never mention. Free feasibility review.

Scale to Exit

Build an Asset

You built a business. We help you build an asset. Transferable. Valuable. Optionable.

Who This Is For

You Don't Need More Tips.

You Need True Wealth Architecture.

You're doing $1-15M in revenue

You're profitable, but no generational wealth

You pay six figures in taxes

Your business can't run without you

You want an eight figure exit. Maybe nine.

You're done with fragmented advisors

If this Describes You, We Should Talk.

Tax Strategies

Tax Strategies Your CPA Isn't Telling You About

Groundbreaking book reveals how business owners and high-income earners can systematically reduce taxes.

Becoming truly wealthy isn't just about making good money—it's about strategically keeping it. Learn how to use the tax code in your favor to build predictable wealth and freedom.

Built for Business Owners

Not W-2 Employees

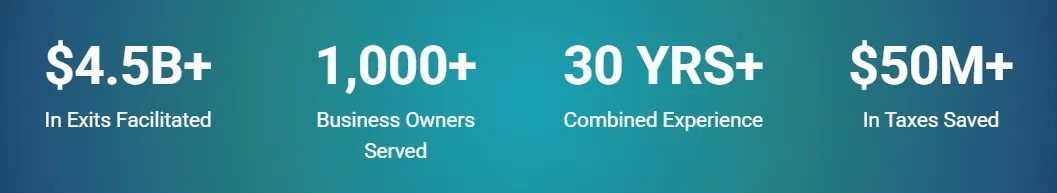

Five partners. Deep bench. One focus: Turn income into generational wealth.

Derick Van Ness

Founder

Rob Williams

Partner | M&A

Justin Martin

Partner | Investing

Brecken Bunnell

Partner | Tax

Justin D. Maxwell

Partner | Wealth

Stop Making Money.

Start Building Wealth.

Your advisors are working in silos. Your tax bill is negotiable.

Your business needs to work without you. This is fixable. Let's fix it.

Let's talk about your wealth strategy

Schedule a 20-minute strategy call. No pitch. Just clarity on whether we're the right fit.

BIGLIFEFINANCIAL

Building family offices for business owners who refuse to settle for middle-class outcomes.

© 2026 Big Life Financial. All rights reserved.